Federal Estate Tax Exemption Amount 2025. Estate and gift tax faqs | internal revenue service. The irs has announced that for 2025, the federal lifetime gift and estate tax exemption amount will increase to $13.61 million per person.

With the adjustments, the 2025 exemption amount is $4,710,800 per person, up from $4,528,800 per person in 2025.

As of january 1, 2025, the federal lifetime gift, estate, and gst tax exemption amount increased to $13,610,000 per person or $27,220,000 for a married couple.

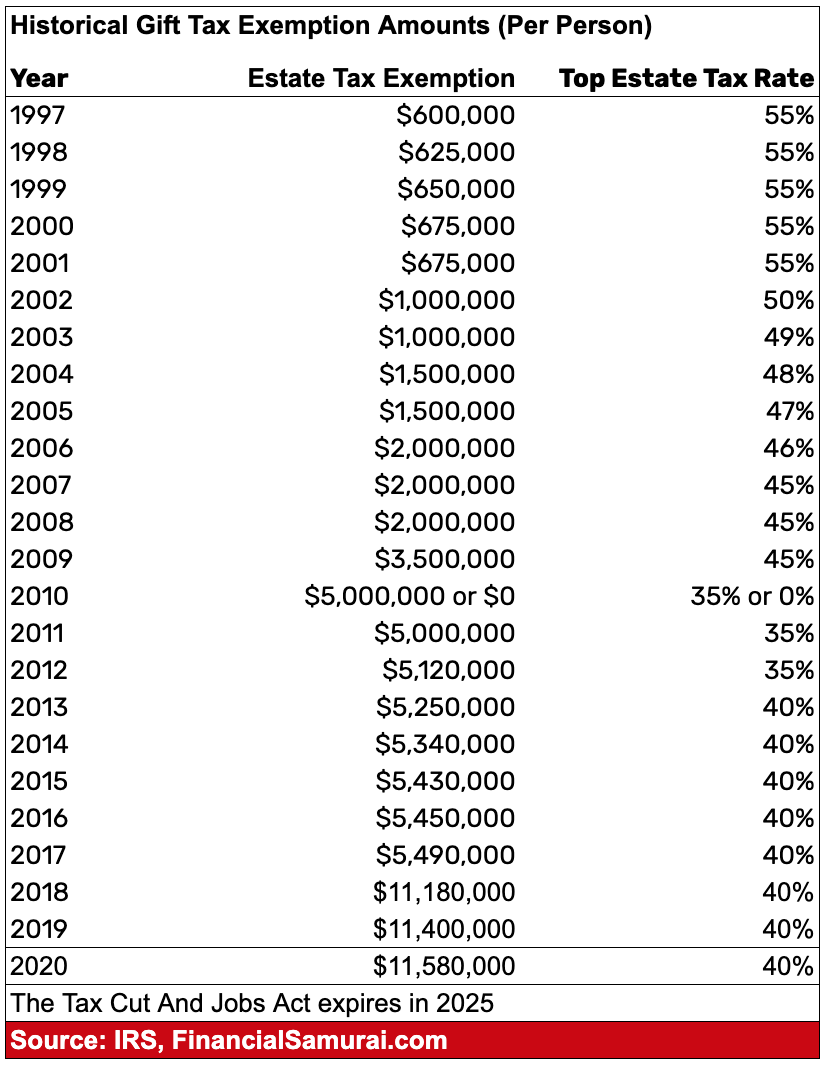

Historical Estate Tax Exemption Amounts And Tax Rates, In 2025, the annual gift tax exclusion rises to $18,000 per recipient per year. The 2025 transfer tax exemption amount is $13.61 million ($10 million base amount plus an inflation adjustment of $3.61 million).

Federal Estate and Gift Tax Exemption set to Rise Substantially for, This means you can gift up to $18,000 to any number of individuals without triggering the gift tax or a. With the adjustments, the 2025 exemption amount is $4,710,800 per person, up from $4,528,800 per person in 2025.

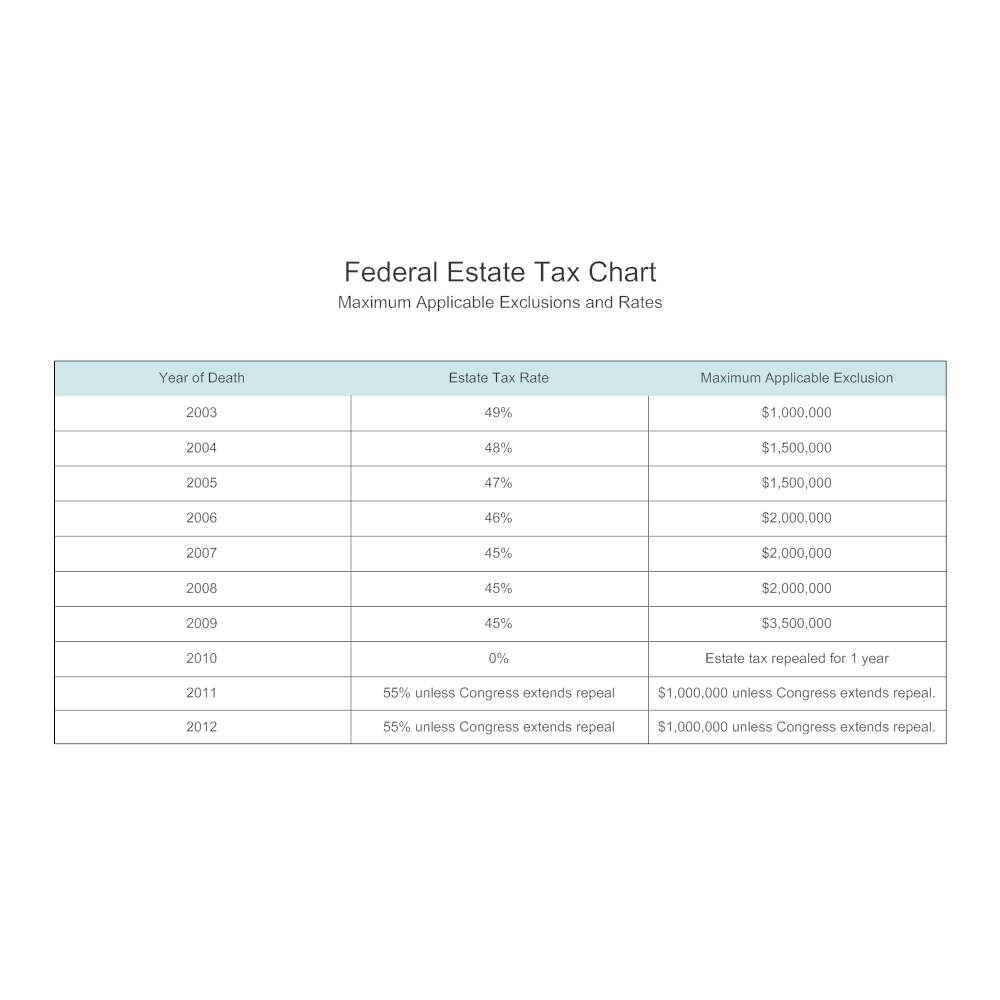

Federal Estate Tax Chart, For people who pass away in 2025, the exemption amount will be $13.61 million (up from the $12.92 million 2025 estate tax exemption amount). Personal income tax rates—for 2025, the nebraska personal income tax rates run from 2.46% to 6.64%.

Historical Estate Tax Exemption Amounts And Tax Rates, Personal income tax rates—for 2025, the nebraska personal income tax rates run from 2.46% to 6.64%. This milestone represents the most substantial tax.

:max_bytes(150000):strip_icc()/estate-tax-exemption-2021-definition-5114715-final-b76b790839b8411db1f967c82ef4b281.png)

Estate Tax Exemption How Much It Is and How to Calculate It, Here we have provided a “cheat sheet” to keep in mind for 2025 federal estate, gift, and gst exemptions, as well as exemptions and inheritance tax consequences in states that impose their own estate,. For people who pass away in 2025, the exemption amount will be $13.61 million (up from the $12.92 million 2025 estate tax exemption amount).

Estate and Inheritance Taxes Urban Institute, The estate tax exemption is adjusted annually to reflect changes in inflation each year. In addition, the estate and gift tax exemption will be.

Estate Tax Exemption Increased for 2025 Anchin, Block & Anchin LLP, On january 1, 2025, the gift tax exemption amount will increase to $18,000, up from $17,000 in 2025. On november 9, 2025, the irs released the new (2025) federal estate tax exemption amount, which will be $13,610,000.00 per u.s.

Estate Tax Chart Fairview Law Group, In 2025, married couples now have a combined total federal gift and estate tax exemption of us$27,220,000. The top rate drops to 5.84% for 2025, 5.2% for 2025,.

Federal Estate Tax Exemption Sunset The Sun Is Still Up, But It’s, The faqs on this page provide details on how tax reform affects estate and gift tax. For people who pass away in 2025, the exemption amount will be $13.61 million (up from the $12.92 million 2025 estate tax exemption amount).

When Can You File Your Taxes In 2025 Cordy Dominga, Typically, heirs won’t pay the federal estate tax unless the value of your estate exceeds the exemption amount. The faqs on this page provide details on how tax reform affects estate and gift tax.

As of january 1, 2025, the federal lifetime gift, estate, and gst tax exemption amount increased to $13,610,000 per person or $27,220,000 for a married couple.

2025 Uk Baseball Schedule. Last season, kentucky used a clever scheduling strategy to win its. Uk is slated to both[...]

New Years Los Angeles 2025. It’s that time of year again, when old. By admin / may 28, 2025. Ring[...]

Lake Erie Bass Tournaments 2025. Series is starting its 14th. Thanks to all the anglers and sponsors. Battle of lake[...]